In June 2024, BBMP was said to have engaged Boston Consulting Group (BCG) as a consultant to increase revenue generation and curb financial leakages. The cost of this engagement was said be upwards of Rs. 50 Crore.

The final reports from this engagement have been delivered to BBMP and they were obtained through RTI by Mr. Devare of the Bangalore Environment Trust. The reports were provided as print copies and they were scanned with the help of Servants of Knowledge. Unfortunately the quality of the print copies weren’t up to the mark and the scans reflect that. You can access the reports here.

The main goal of the consultation is to help BBMP generate more revenue and be more financially sustainable. For that purpose, BCG compares BBMP with its peers – Mumbai (BMC), Hyderabad (GHMC), Pune (PMC), Chennai (GCC) and Ahmedabad (AMC) – to see how these other cities are doing and how they are generating revenue.

Among the suggestions, the key ones concern increasing property tax revenues (residential and commercial), increasing non-tax revenues, restructuring solid-waste management and guidance on funding large projects like the tunnel roads and elevated corridors.

In this article, we look at the comparison with other cities, large infrastructure projects and the changes to property taxes proposed. Solid-waste management changes need a separate analysis.

Revenue situation and large projects

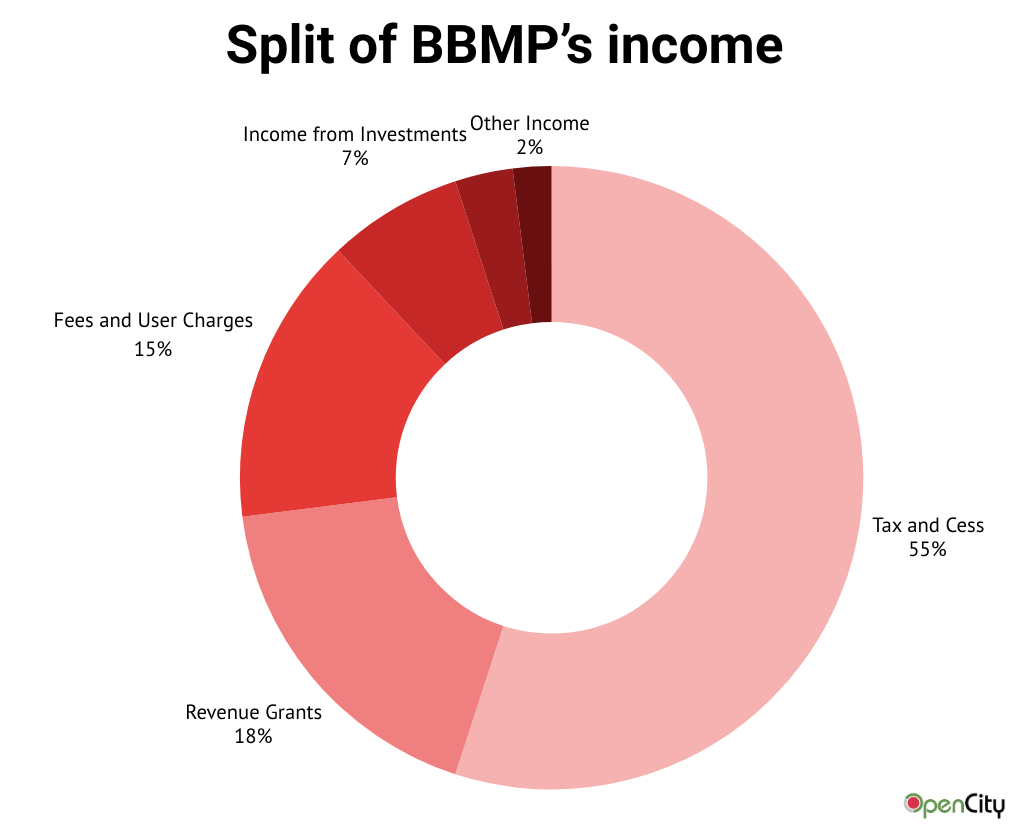

The report notes that BBMP’s revenue comes mainly from property tax and cess, which account for 55% of the total revenue. This is followed by revenue grants, from the state government at 18%.

For the Financial Year 2026 (2025-26), the revenue was Rs. 20,465 Cr including grants. Only Rs. 10,681 Cr was generated through property tax and other revenue instruments, with a grant of Rs. 8,779 Cr from the state government.

However, the expenses for the year amount to close to Rs. 20,634 Cr. Grants from the state government play a large part in making up the massive shortfall in generated revenue.

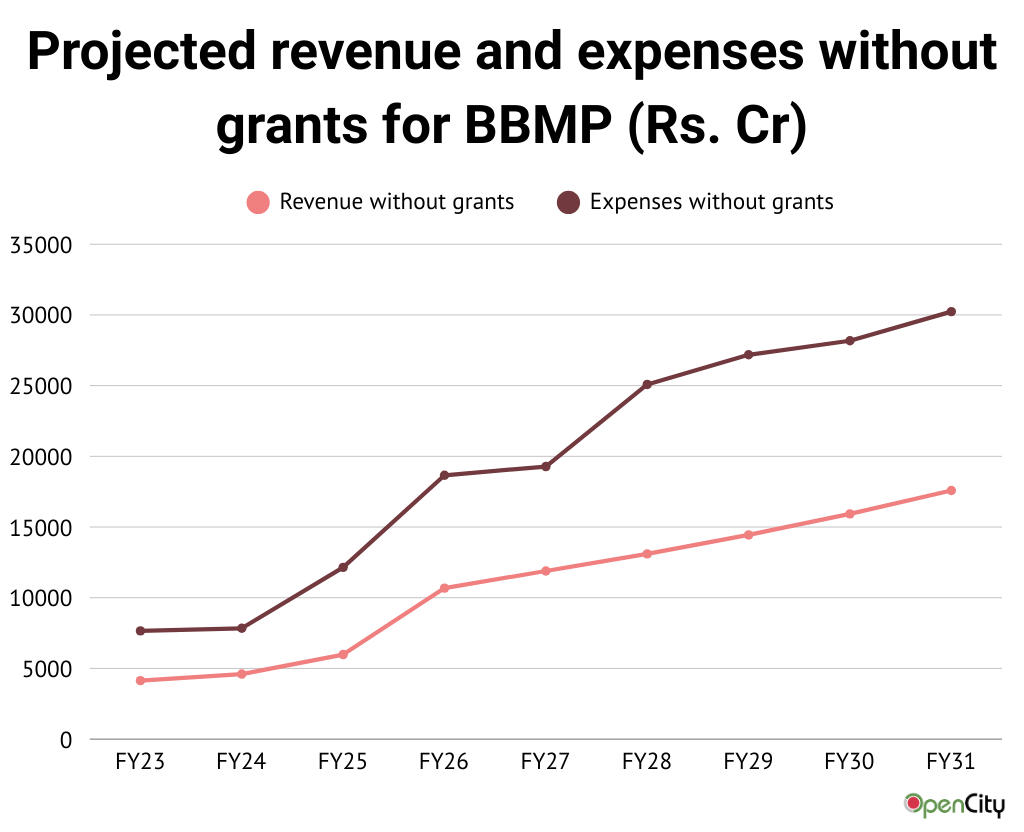

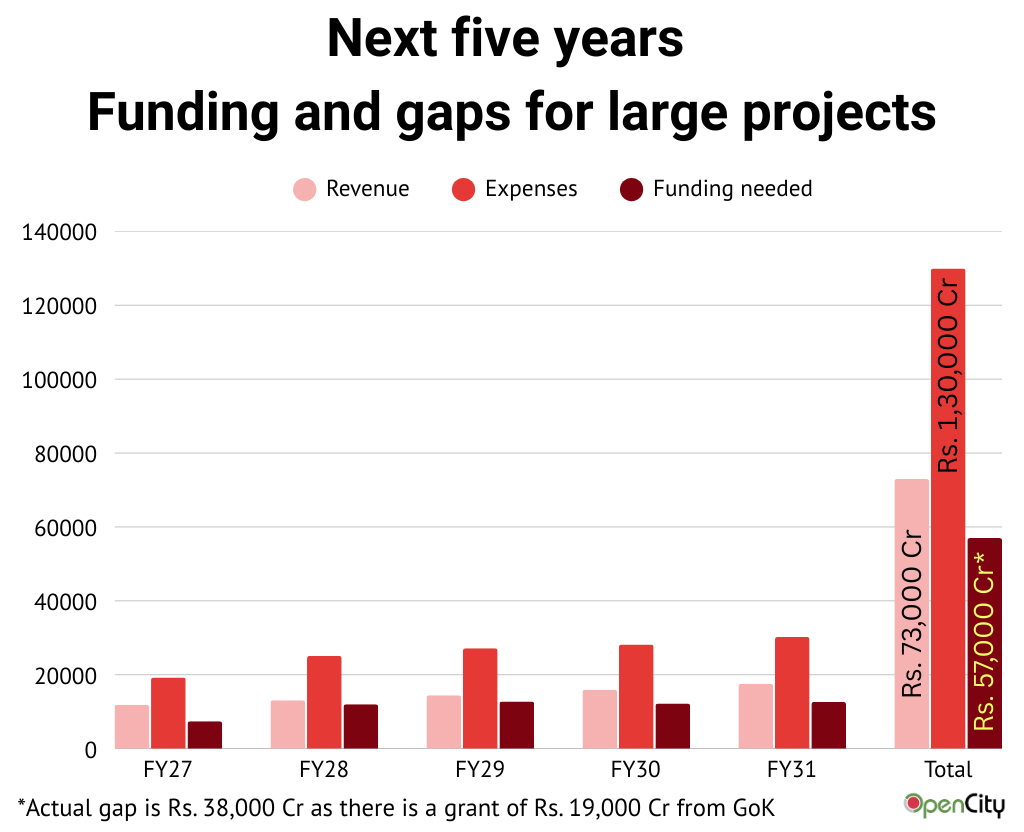

The growth of revenue, with increase in property tax collections, trade license fees, newly notified premium FAR and advertisement fees is expected to increase the revenue without grants to Rs. 17,586 Cr in the next five years. However, with large infrastructure projects in the offing, the expenses are also expected to climb to Rs. 30,236 Cr in the same period.

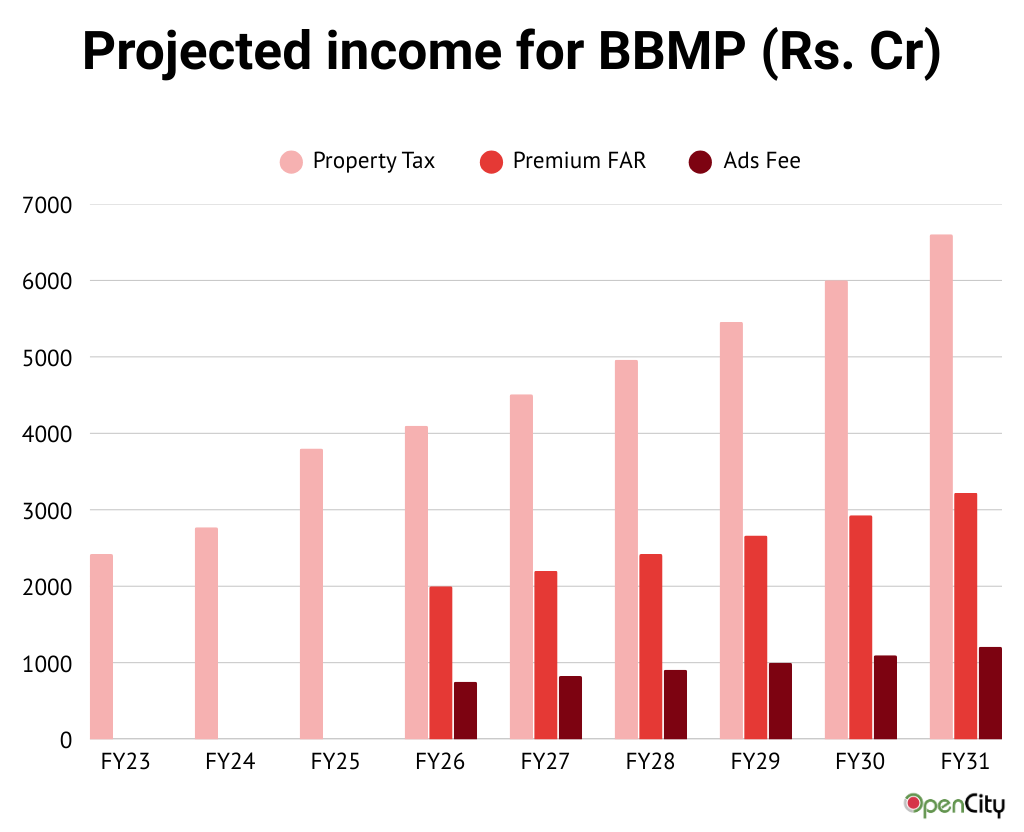

The increase in revenue will be driven by improved property tax collections, premium FAR collections and revenue from advertisements, which are expected to grow at a rate of 10% year on year.

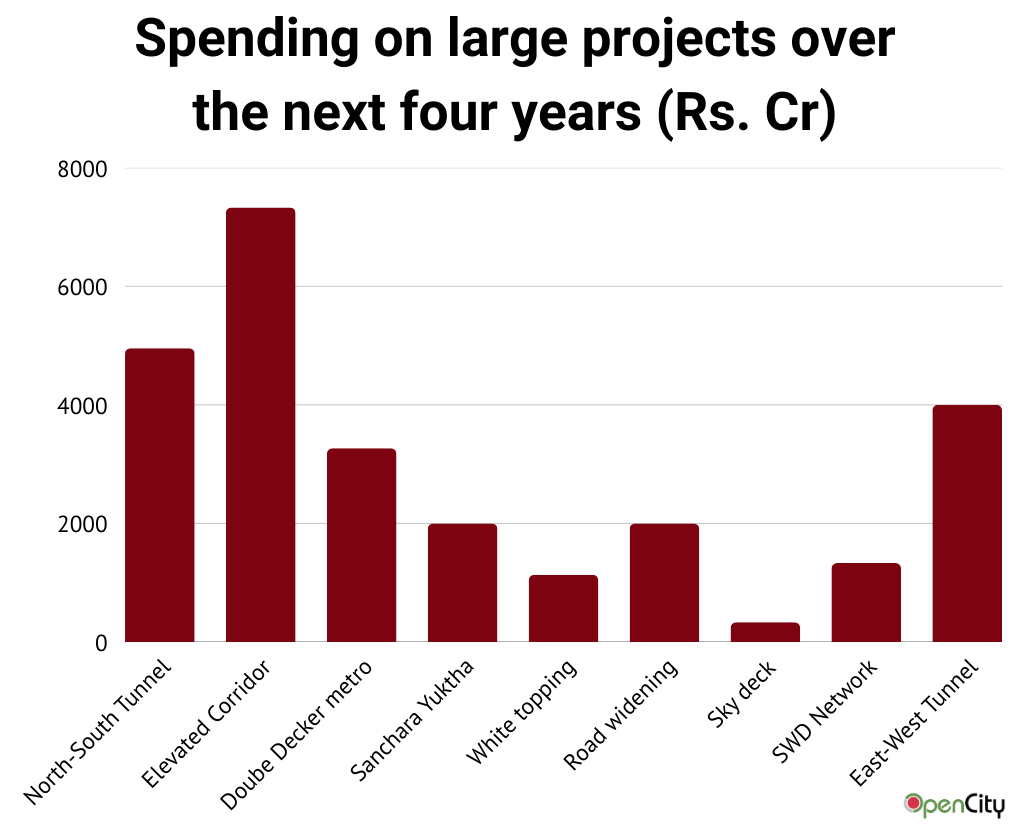

The expenses, however, are expected to rise with large infrastructure projects like the tunnel roads, double-decker flyover and elevated corridors among the big ticket projects. Over the next four years they are expected to cost the exchequer a total of Rs. 26,352 Crore.

With the revenue failing to catch up, the city is looking at a shortfall of Rs. 57,000 Cr by the year 2031. While the state government has promised a grant of Rs. 19,000 Cr, the massive shortfall of Rs. 38,000 Cr will need to be bridged through grants and debt.

Comparison with other cities

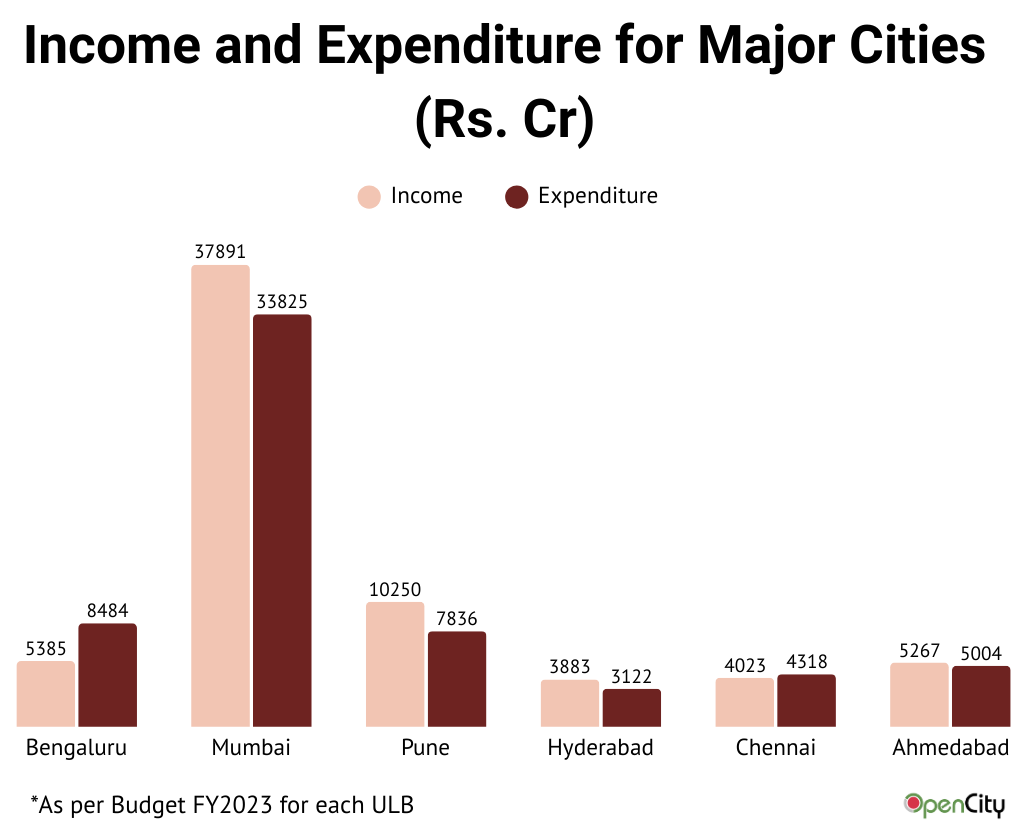

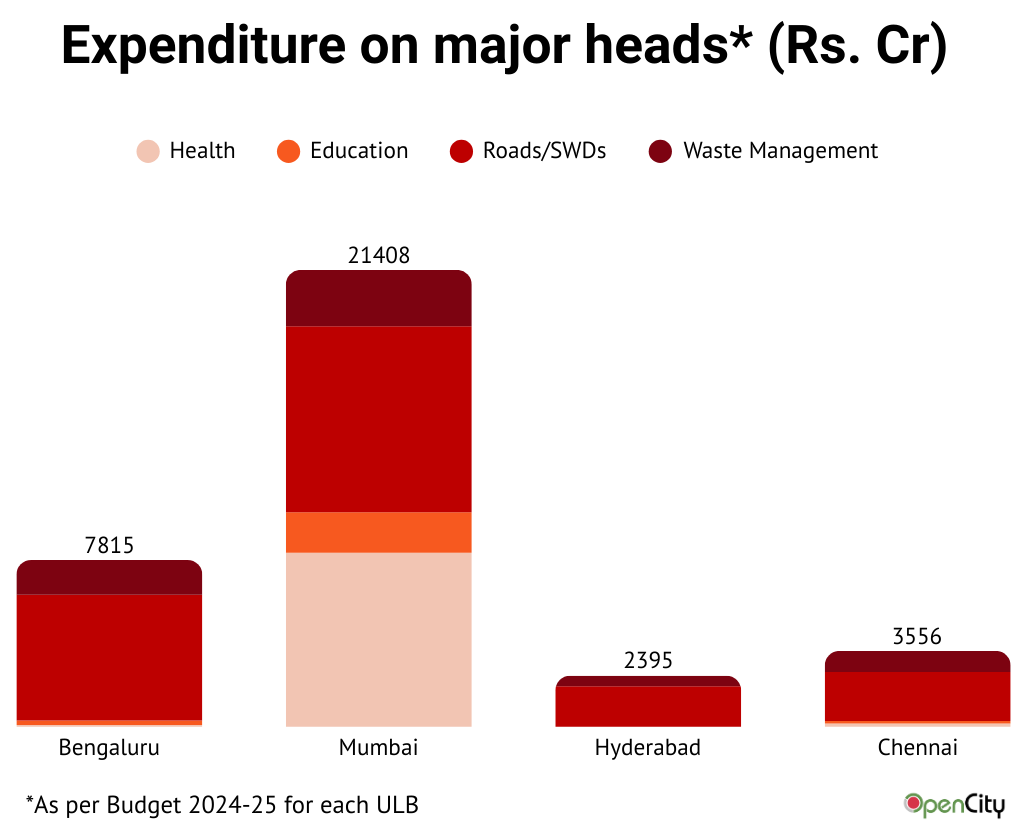

The report compares the situation with other major cities with similar population – Mumbai, Pune, Hyderabad, Chennai and Ahmedabad. The report notes that despite having a large population, the outlay for Bengaluru is much smaller than cities like Pune and Mumbai. However, the report notes that both PMC and BMC include parastatals like water and sewerage which don’t come under BBMP’s jurisdiction.

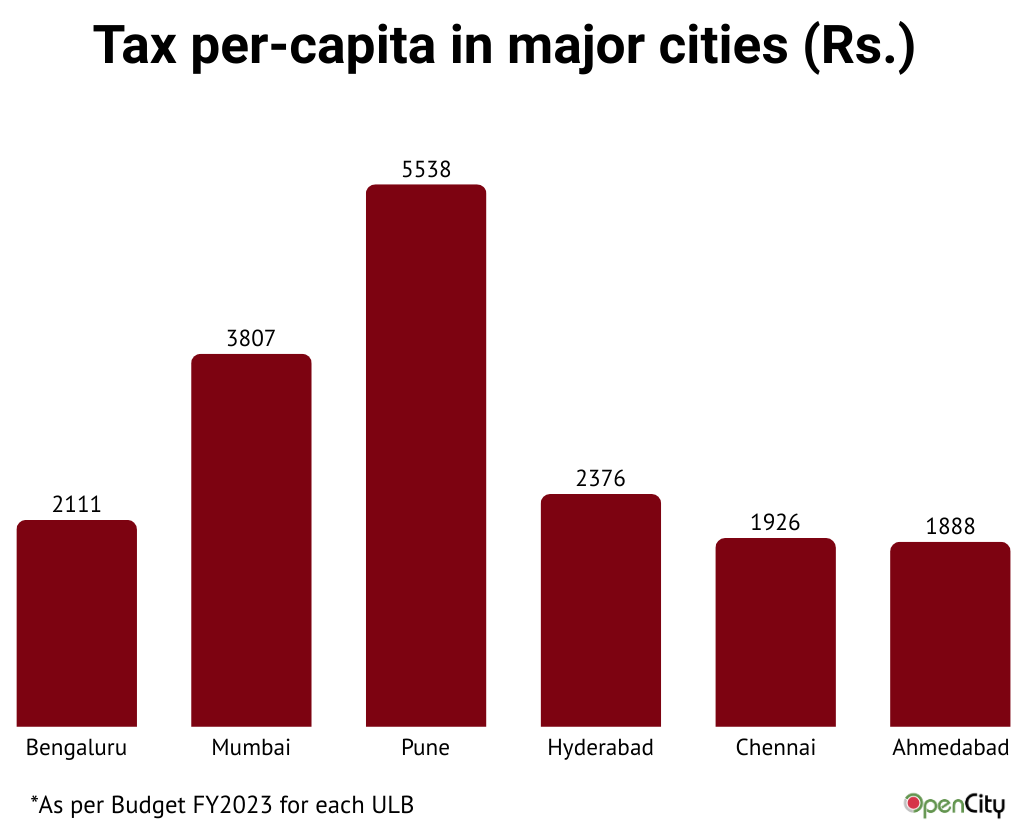

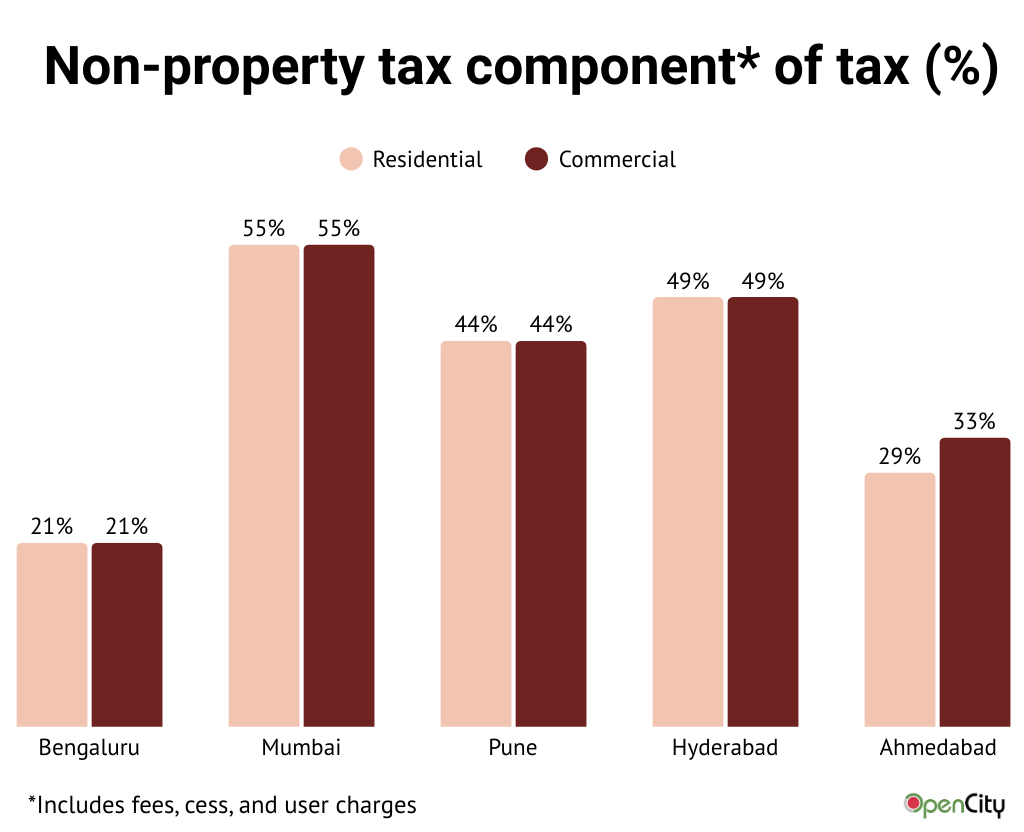

However, even excluding water and sewerage taxes, an average person in Bengaluru pays much less tax that their counterpart in Pune and Mumbai, or even Hyderabad.

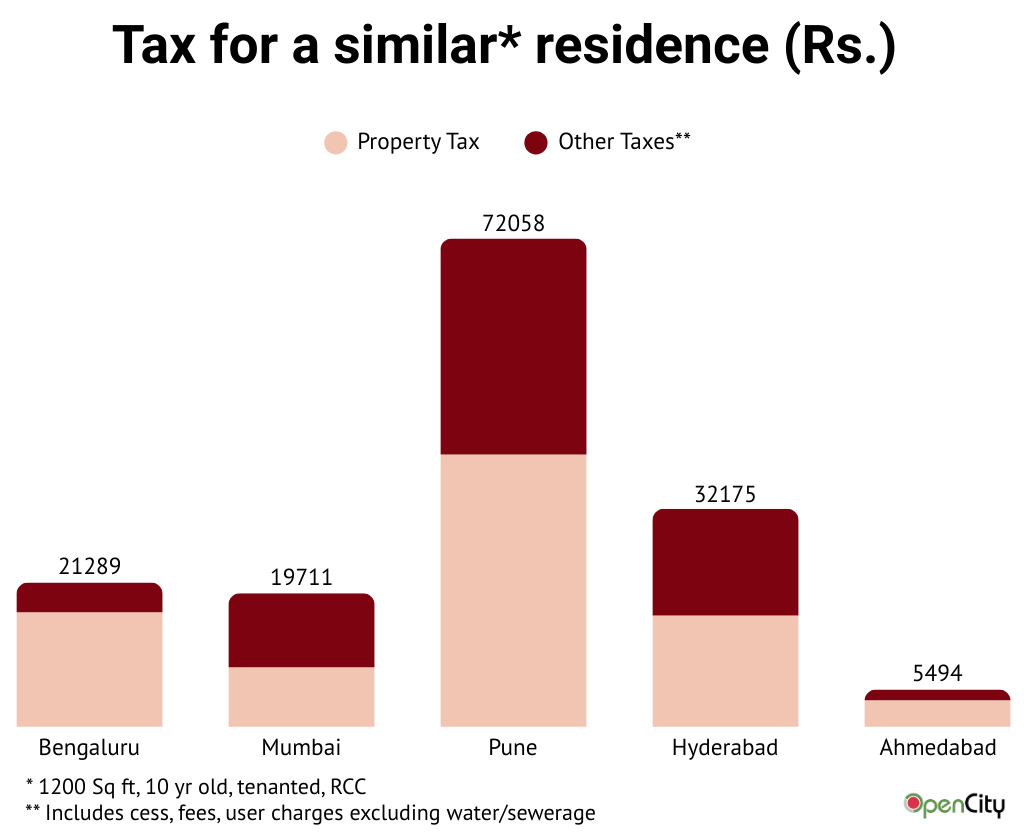

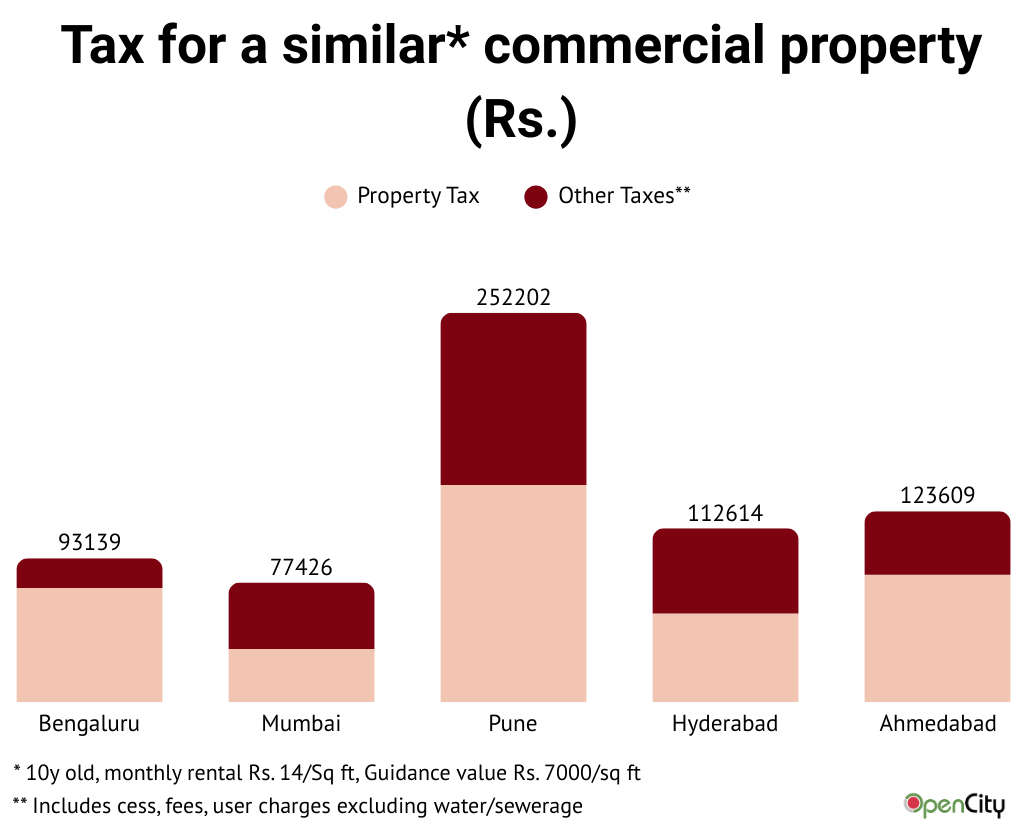

For a similar property, of 1200 sq ft, 10 years old and rented out in a premium area, the tax in Pune is much higher than in other cities. Interestingly, in most cities, other taxes and cesses make up a large component or even exceed the actual property tax paid.

The same relationship also holds for commercial properties. Other-taxes and cesses make up a large component for every city other than Bengaluru.

In all cities, except in Bengaluru, the other taxes and cesses make up a large component of the total taxes paid. This is an important takeaway from the comparison with other cities, and the report recommends using premium FAR, advertisement charges, trade licensing rates to widen the tax base and increase revenue.

However, when it comes to spending their revenue, most cities prioritise large projects like road works and solid waste management. Health and education are visible components only in Mumbai with cities like Hyderabad entrusting them to state government departments. Bengaluru and Chennai have negligible outlays and most of the amounts usually remain unspent.

Property tax recommendations

The main recommendations from BCG include revamping the solid waste management system, using a different annuity model for tunnel roads, changes in property tax collection and in the trade licensing system. For this analysis, we will look only at the property tax changes proposed.

In March 2024, the BBMP proposed a guidance value based system to compute property tax. The plan was put in the back-burner due to opposition from multiple quarters. BCG, in its report recommends bringing that system back with some minor modifications.

Residential property

The recommendation for residential property tax is to have a five-slab system based on the property value, and a different rate for each slab.

| Slab | Property Value | Rates | Senior Citizen Rebate |

| Slab 1 | Upto 50 Lakhs | 0.1% | 5-10% |

| Slab 2 | 50 Lakhs – 1 Cr | 0.15% | 5-10% |

| Slab 3 | 1 – 2 Cr | 0.2% | |

| Slab 4 | 2 – 5 Cr | 0.25% | |

| Slab 5 | Above 5 Cr | 0.3% |

The increase in property tax will be capped at 110% and have a floor of 90% for the first year. So your increase in property tax will be gradual. The report recommends charging both tenanted and self-occupied properties at the same rate.

A property valued at Rs. 80L will have to pay a tax of Rs. 12,000 with additional cesses on top of it. However, if the current tax was much less than that, it will increase at a rate of 10% each year until it reaches Rs. 12,000. For instance, if the current tax is Rs. 10,000 it will rise to Rs. 11,200 before increasing to Rs. 12,000 in the second year.

While the proposed system had detailed steps on computing your property value especially for constructed buildings, the BCG report does not mention any such steps. The assumption seems to be that the guidance value system used for registration will be used entirely.

The report also recommends having a “Floor Factor” where people living in high rises pay more. While those in floors up to the fifth don’t need to pay extra, those in floors 6-10 pay 1.05 times the property tax, in floors 11-20 pay 10% more and above the 20th pay 15% more.

This means that for a property in floor 7, valued at Rs. 1.2 Cr, the base property tax will be Rs. 24,000 (0.2%) and a floor factor of 1.05 will raise it to Rs. 25,200.

Commercial property

Commercial properties will also have a similar system with properties divided into four categories.

| Category | Tax Rates | Ceiling |

| Less than 1 lakh sq ft | 0.5% of guidance value | +20% |

| 3 star and lower hotels | 0.5% of guidance value | +20% |

| More than 1 lakh sq ft. | 0.75% of guidance value | +30% |

| 4 and 5-star hotels | 0.75% of guidance value | +30% |

The property tax for commercial buildings is not linked to the earning from them but to their guidance value. A building of 6000 sq ft, valued at Rs. 1.5 Cr would have to pay a property tax of Rs. 75,000 and the year on year increase to get there from current rates would be capped at 20%. This means that if the current property tax is Rs. 50,000, the tax for the next year would be Rs. 60,000, and then Rs. 72,000 before reaching Rs. 75,000 in the third year.

Increasing collection efficiency

The report notes that 2.5 Lakh registered properties are not paying taxes and need to be brought into the system. It recommends the following measures to improve collection efficiency:

- Ease of payment online with less number of clicks. Tie-ups with payment apps like Google Pay, Paytm and CRED is recommended.

- Monthly EMI option. A lumpsum each year might be difficult to manage and splitting it up into a monthly payment might make it easier to pay while also softening the amount.

- Public awareness and transparency campaigns. TV ads, social media outreach and neighbourhood level workshops can help increase the total collection by 10%.

- Amnesty and incentive schemes. Cities like Delhi and Pune utilized one-time amnesty schemes where people voluntarily disclose assets and bring them into the tax net. Rebates for timely payments, similar to the 5% currently followed by BBMP can also incentivise people to pay on time.

Widening the net

The report notes that there are 5 Lakh unassessed properties which need to be brought into the tax net. For this, it recommends the following steps.

- Cross-referencing with utilities like BESCOM.

- GIS-based property mapping and detection. The current e-khata system is likely to help with this.

- Integrated data sharing from land department. Details from revenue department can help bring properties and their usage to BBMP’s notice.

- Reclassification of properties based on actual usage. BMC and Chennai Corporation use trade license issuance to classify properties and such a system can be adopted by BBMP too.

These are the main recommendations from BCG to BBMP. While the tax based recommendations can bring in more money, it is likely that most of it will be spent on big-ticket items like tunnel roads and elevated corridors.

This expenditure will come at the cost of services like solid-waste management, potholes, health and education. BCG, unfortunately, has no major recommendations to improve these services.