The BBMP budget is an important document laying out how the Urban Local Body plans to spend money during the next Financial Year (FY). The budget itself consists of multiple documents, the budget speech which is the speech by the chairman presenting the budget, the budget book which is the main money document with details of receipts and expenses, and a budget highlights which has the high-level numbers from the budget.

In this explainer we will try to understand how to read the Budget Book as this is where the individual allocations are specified at a very granular level. For the purpose of analysis we will use the budget 2025-26 as example.

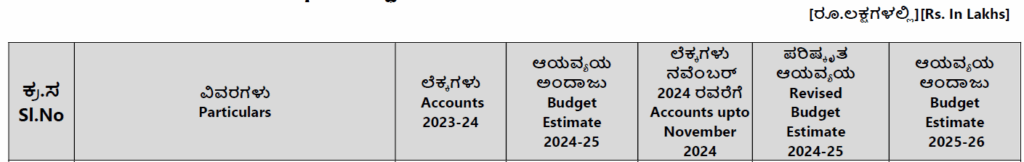

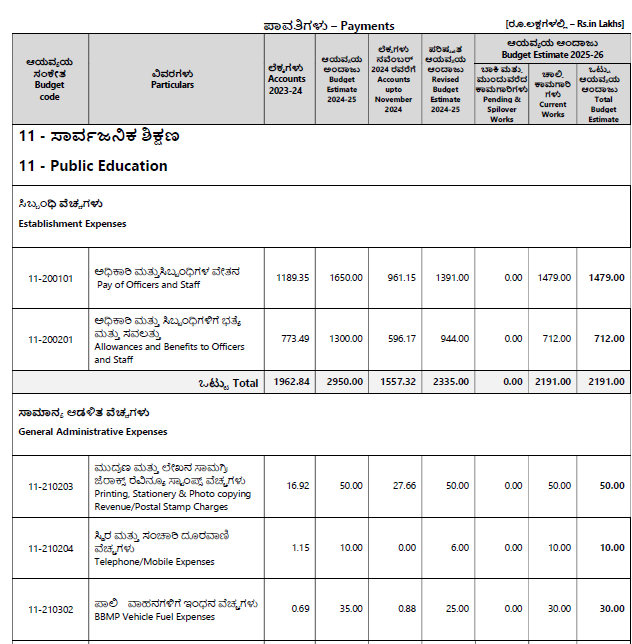

Main Columns

A budget is both a forward looking document detailing the outlay for the upcoming financial year (FY) as well as a backward looking document which includes information of the two years before that. So it not only tells you how money is going to be spent in the upcoming FY(2025-26 in our example), but also how money was exactly spent in the previous FY (2023-24), and more accurate estimates for the current FY(2024-25).

The main unit of the budget is Rs. Lakhs. All amounts need to be read as lakhs unless specified otherwise. An amount of 27000 under a header would thus be Rs. 27000 lakhs or Rs. 270 Crores. To read in crores, you just have to ignore the last 2 digits before the decimal.

The budget has five main columns and all the details below will be read with the five columns. They are:

- Accounts from the previous Financial Year (FY). These are actuals that were realised in the previous FY. For the budget 2025-26 this would be the details from FY 2023-24.

- Budget Estimate of the current FY. The current year is when the budget is being presented. Since the budget is presented in February or March, the current year for the budget of FY 2025-26 would be 2024-25. This was the outlay from the previous budget.

- Actuals upto November of the current FY. In this case, the actuals upto November 2024.

- Revised Budget Estimate for the current FY. Based on the actuals till November how much is expected to be spent or received for the current FY once March 31st rolls in. In this case, the updated estimate for the FY 2024-25.

- Budget estimate for the upcoming FY. The outlay in the case of expenses or expected money coming in in the case of receipts for the upcoming FY. This is the main column that people look for to know how BBMP is planning to spend money in the next FY, in our case 2025-26.

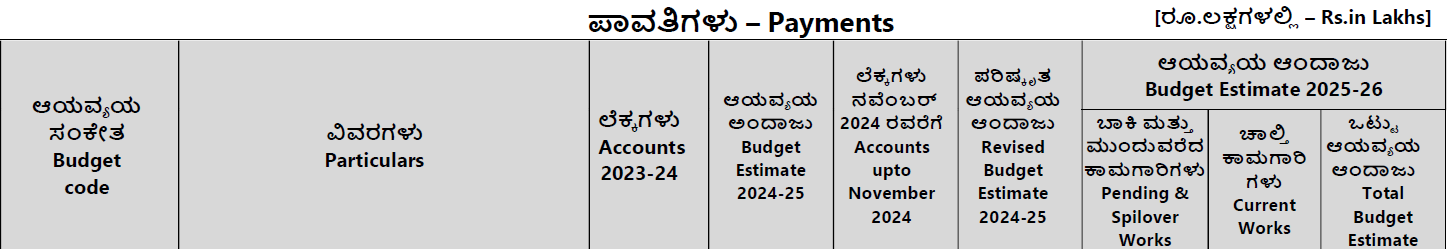

At a more granular level, in the case of expenditure, this column is further split into three columns:- Pending and spillover works – This refers to ongoing works/projects and money being spent for them.

- Current works – money being given for new works that will be initiated during the FY.

- Total Budget Estimate – the sum of the above two.

These columns run throughout the budget except in the case of zonal grants. Details of all money spent or received will need to be read as split into the above five columns.

Main Heads

The budget has the following main headers or chapters.

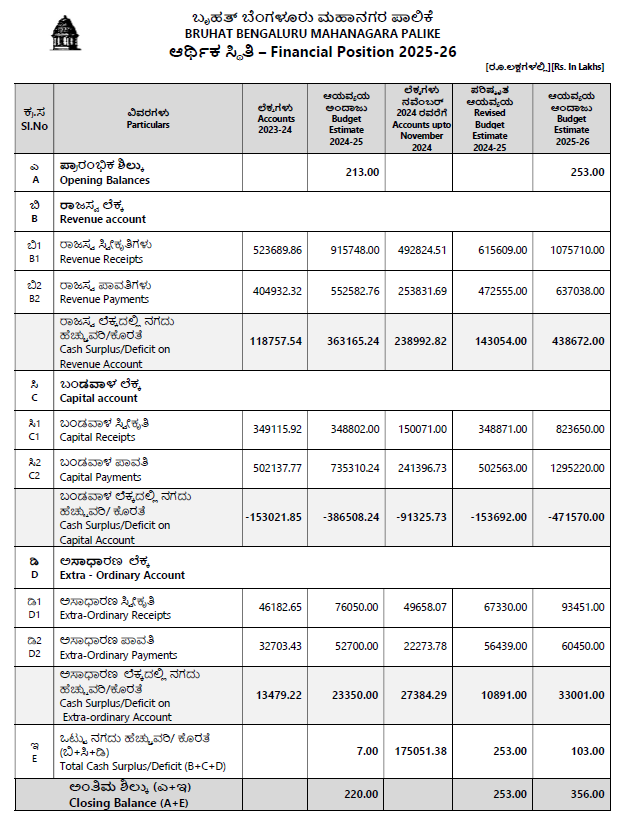

Financial Position

This is a high level view of the budget. It tells you how much money was received from which main sources, how much money is going to be spent, among which main heads. The difference between the spending and receiving gives you the financial position. A position that is positive means a revenue surplus budget, while a negative value is a deficit budget. In the case of 2025-26 it is expected to be surplus budget by Rs. 3.56 Crore.

This section starts with the Opening Balance which is the money brought forward from the current year’s surplus/deficit as per the Revised Estimates and to this expected receipts and expenses are added or subtracted.

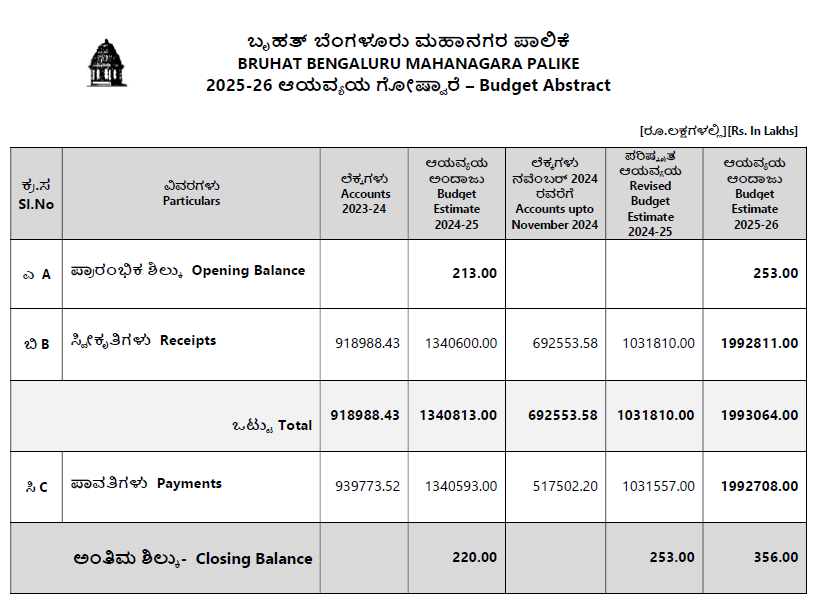

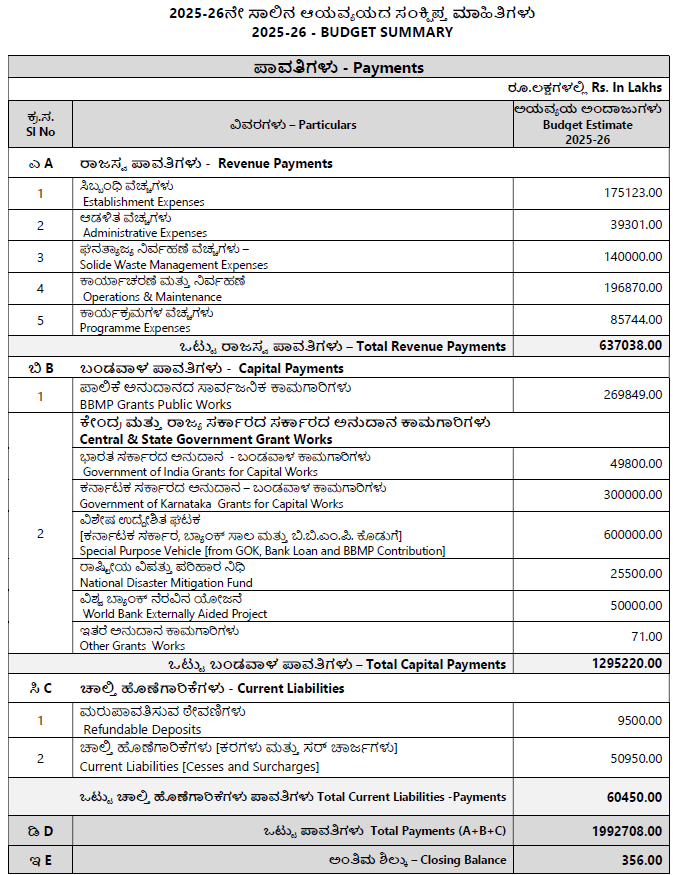

Budget Abstract

This is the highest level view of the budget which tells you only the income(Receipts) and the expenditure(Payments) and how they add to be a surplus or deficit budget. The value for Payments for the next FY is the total budget outlay that is quoted in the press after the budget is presented. In the case of 2025-26 it is the number: 1992708.00 which translates to Rs. 19,927.08 Cr.

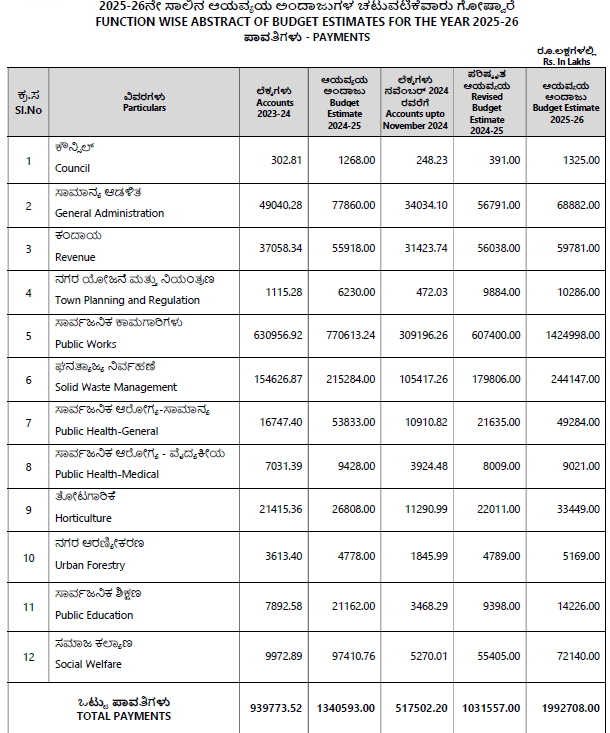

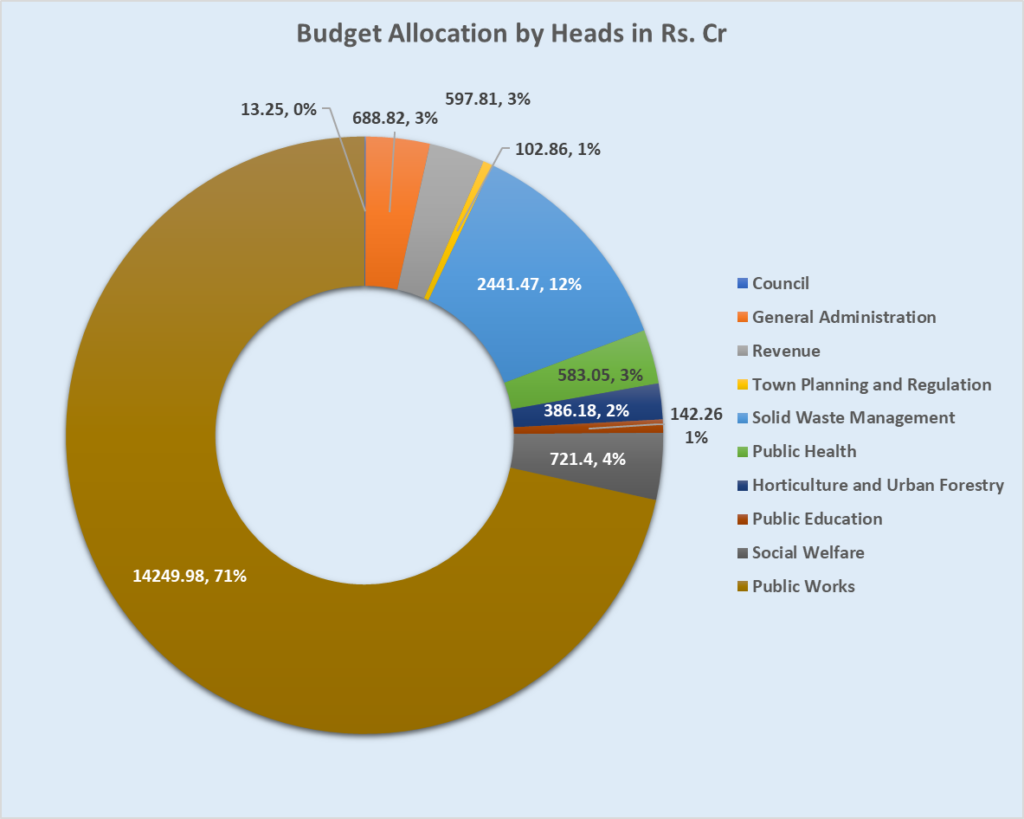

Function-wise abstract of Budget Estimates

Department-wise receipts and payments are tabulated here. The budget is split under 12 departments under BBMP.

| Department | Function |

|---|---|

| Council | The elected council which BBMP has not had since 2020. |

| General Administration | Internal administration of BBMP, including Human Resources, maintaining the secretariat, etc. |

| Revenue | Collecting property tax, issuing khatas, and other revenue-related activities. |

| Town Planning and Regulation | Regulating land use, enforcing building bye-laws, issuing Occupancy Certificates, etc. |

| Public Works | Maintenance and development of roads, footpaths, stormwater drains, streetlights, lakes, etc. |

| Solid Waste Management | Collection and processing of solid waste. |

| Public Health – General | Non-disease-specific public health services including sanitation, public toilets, hygiene, food safety and licensing, slaughterhouse regulation, etc. |

| Public Health – Medical | Disease-specific health services including BBMP hospitals, Urban PHCs, Namma Clinics, dispensaries, etc. |

| Horticulture | Maintenance and development of parks, planting and pruning avenue trees. |

| Urban Forestry | Tree planting, afforestation, tree census and monitoring, and tree protection—closely linked with horticulture. |

| Public Education | Maintenance of BBMP schools and anganwadis, hiring teachers, providing mid-day meals, etc. |

| Social Welfare | Welfare schemes for marginalized groups such as Pourakarmikas, SC/STs, minorities, persons with disabilities, etc. |

The first section is the higher level Receipts for each of these departments – money expected to be earned as revenue or grants. Next is the department-level Payments or money expected to be paid to each of these departments.

This page can give you a high level view of how money is being split across the headers and which department is getting the most money. The biggest chunk usually goes to Public Works and Solid Waste Management. For instance, in 2025-26 these two heads accounted for 83% of the total outlay.

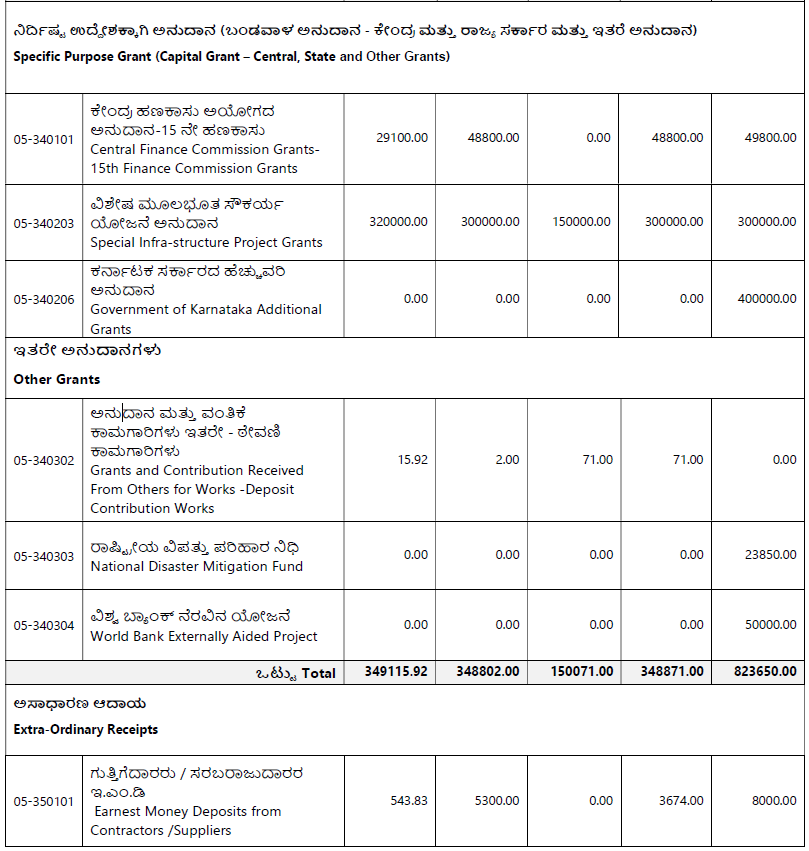

Function-wise Receipts

Detailed receipts of money under each department are tabulated here. The receipts under each department are split into different headers like:

- Non-tax revenue: Revenue from RTI fees, bank interests, rental fees, penalties, burial ground/crematorium fees come under this

- Tax and Cess revenue: Tax and cess collected by the department involved. Property tax, SWM cess can be found here under the Revenue department.

- GOK-Revenue Grant: Money granted by the Government of Karnataka through the state budget.

- Extra-Ordinary receipts: Deposits and security deposits collected.

- Special Purpose Grants: Central grants like JnNURM or Smart Cities show up under this.

- Other Grants: World Bank funds, National Disaster Management Funds are listed under this.

Function-wise Payments

This is the section where the spending of money over the year is listed at a granular level. Details on how much is allocated for lakes, streetlights, or landfills can be found here.

Like with receipts, Payments is split into the following headers:

- Establishment Expenses: Payment and allowances for staff.

- General Administrative Expenses: Printing, stationery, telephone, electricity charges, maintenance of vehicles etc for the offices.

- Functions and Ceremonies: Spending on conducting functions like Rajyothsava, Independence day, and felicitations.

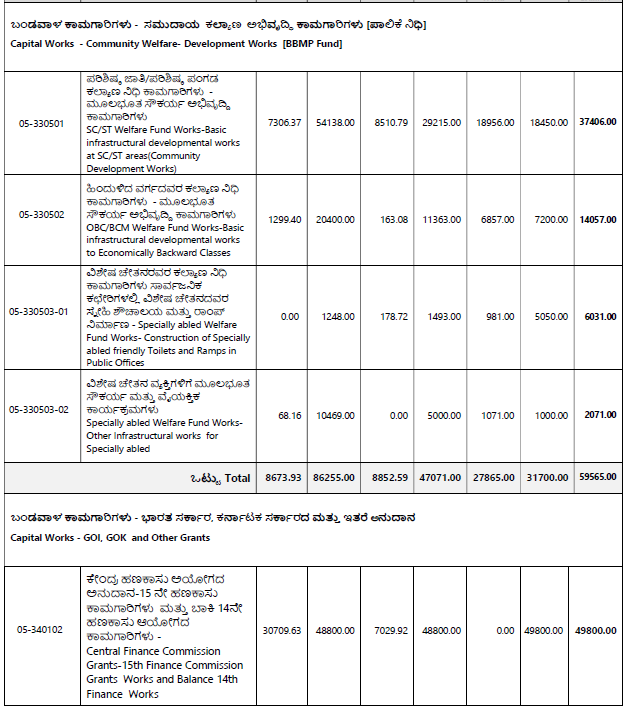

- Capital Expenses: This is the actual spending on creating new assets. Building a new flyover or a new Waste-to-Energy plant would be under Capital Expenses.

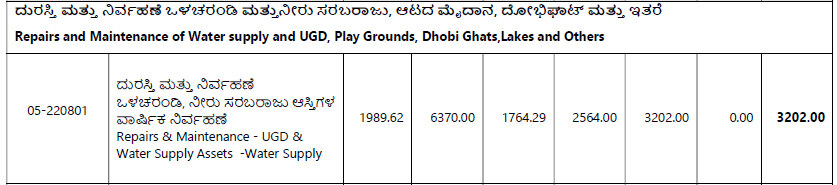

- Operation and Maintenance: Maintenance of existing assets like landfills, footpaths,, roads, streetlights, stormwater drains etc.

Each row under these has a budget code on the left-most column. A budget code is the lowest unit of detail in the budget.

Capital expenses and operation and maintenance can be split under other large headers. In the case of public works for instance, repair and maintenance has different sections for

- buildings

- roads, footpaths, surface drains, flyovers etc,

- streetlights and electrical fittings.

- water supply and underground drains, play grounds and lakes.

Capital Expenses in the case of Public Works is shows as “Capital Works” and is split into multiple grants.

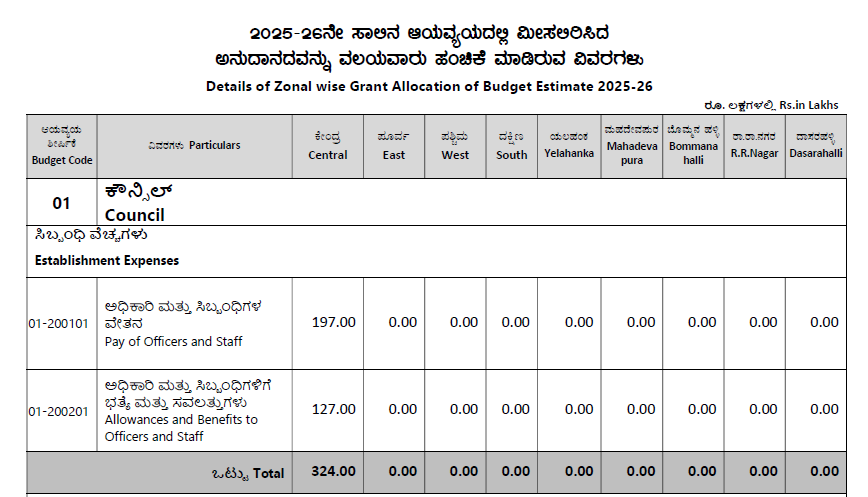

Zone-wise allocation

Since 2024-25 the budget has a zone-wise allocation of funds. This shows the payments across the same 12 functions/departments as before and along the same five sub-heads as in payments above. However, the columns are the 8 zones: Central, West, East, South, Yelahanka, Mahadevapura, Bommanahalli, R.R. Nagar and Dasrahalli.

The largest allocation across all the heads is to the Central Zone. There are technically only seven zones under BBMP with no such zone as Central Zone, but it likely refers to money kept with the BBMP to be spent across zones.

Budget Summary

The summary of the budget with just the estimates for the upcoming FY, in this instance of 2025-26. Both Receipts and Payments are given at a high level in the budget summary.

These are usually the main headers in the budgets. The budget 2025-26 includes a one-pager on Brand Bengaluru and expenditure on it over three years. This is a special grant and it not usually part of regular budgets.

While it is good to see zone-level payments being part of the budget since the last two years, it is necessary that zone-level receipts are also included so that we get an idea of commercial and residential tax and cess collections. Many assets like footpaths are grouped together with storm-water drains and flyovers. Having separate budget codes for each of these would be helpful.

Most city budgets follow a similar, if not identical format, with variations in the departments and divisions within each head. Understanding the BBMP budget using this explainer can help you approach other city budgets with a slightly surer footing.